Tax Evasion Explained: Laws, Risks, and Consequences

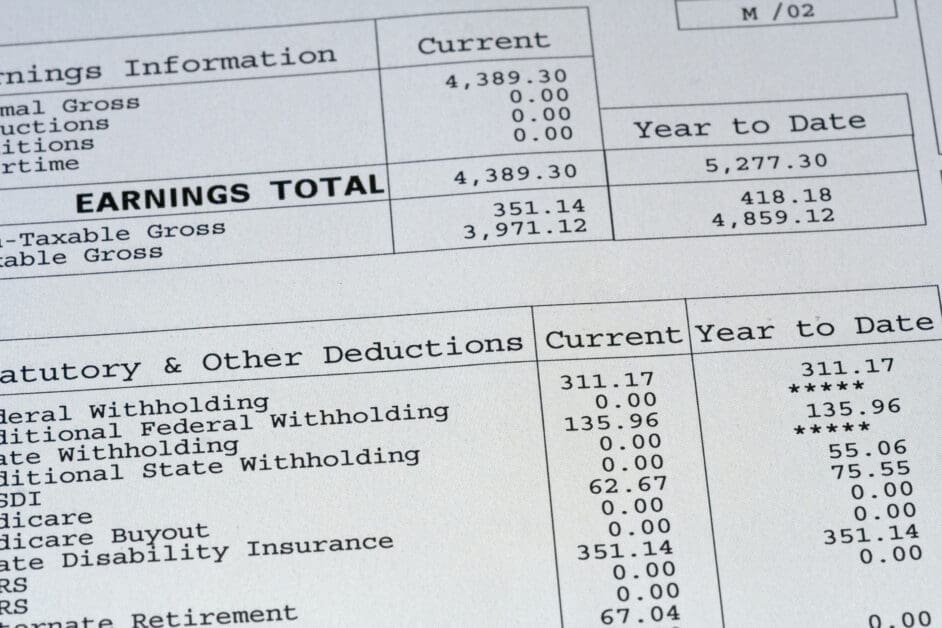

Tax evasion is deliberately avoiding taxes through illegal methods like hiding income or claiming false deductions. Unlike legal tax avoidance, it’s a crime with serious consequences. Common forms include unreported cash, crypto tax evasion, and offshore accounts. Understanding the line between legal and illegal is crucial.

Tax Evasion Explained: Laws, Risks, and Consequences Read More »