Employee Right to Pay Transparency: How Pay Stubs Support Fair Wage Laws

Pay transparency has become a major focus in employment law as lawmakers, enforcement agencies, and worker advocates push for fair wages and accountability in the workplace. One of the simplest tools supporting this effort is something every employee should receive: a pay stub. These documents do more than show weekly or biweekly earnings. They play a crucial role in ensuring transparency, preventing wage theft, and helping employees understand and enforce their rights under federal and state labor laws.

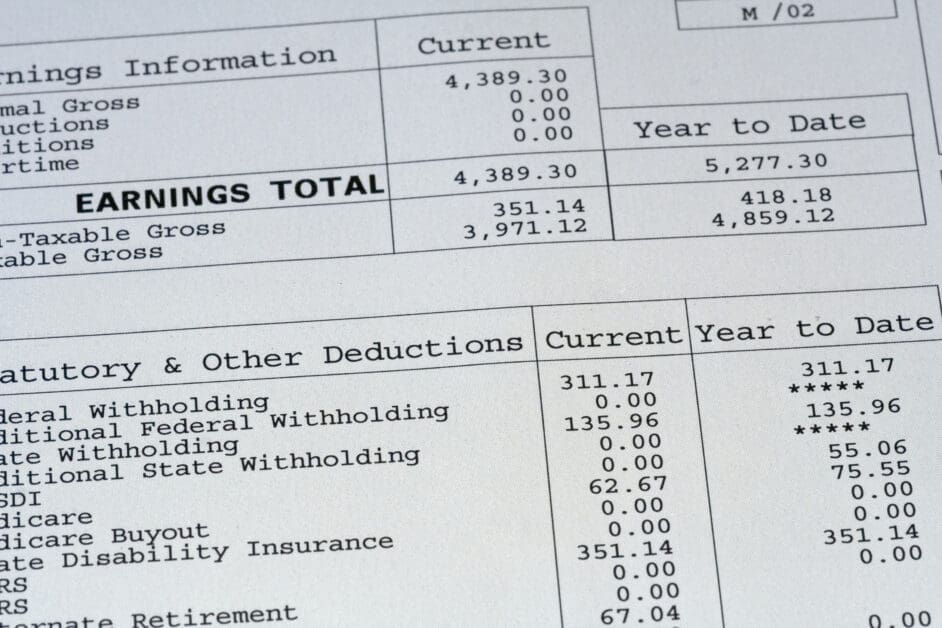

Pay stubs offer a breakdown of what workers are paid, how they are paid, and why certain deductions appear on their checks. In a time when wage disputes are increasingly common, these records serve as vital evidence that protects employees and guides employers toward compliance.

Why Pay Transparency Matters

Wage inequality and payroll discrepancies still affect millions of workers. Studies routinely show pay gaps by gender, race, and job classification, often hidden behind unclear compensation practices. Without clear earnings documentation, workers may not realize that they are being underpaid or that their wages have been incorrectly calculated.

Pay transparency allows workers to make informed decisions about their employment. When pay information is clearly presented, employees can confidently verify that they are being compensated fairly according to minimum wage laws, overtime rules, and agreed-upon pay rates. It also discourages intentional underpayment since employers are aware that inaccurate documentation could lead to legal consequences.

Legal Requirements for Pay Stub Reporting

Although federal law does not explicitly require employers to provide pay stubs, several regulations indirectly enforce payroll transparency. The Fair Labor Standards Act mandates accurate wage record keeping, and many states take this further by requiring that workers receive itemized pay stubs each pay period.

Pay statement laws vary widely by state. Some require digital or physical access to pay data, while others specify the exact information that must be included such as:

• Gross wages

• Net wages

• Overtime hours and rates

• Payroll deductions

• Employer contributions

• Pay period dates

Employers who fail to provide compliant pay documentation risk penalties, employee lawsuits, and wage audits. For employees, access to pay stubs is an essential safeguard that reinforces accountability in payroll processes.

The Role of Pay Stubs in Wage Theft Prevention

Wage theft is one of the most widespread labor violations, costing workers billions every year. This includes unpaid overtime, illegal deductions, misclassification of workers, and failure to meet minimum wage. Wage theft often goes unnoticed when employees lack clear records of their earnings.

Pay stubs empower employees to identify discrepancies such as:

• Missing overtime pay

• Incorrect hourly rates

• Unauthorized deductions

• Misreported hours worked

With accurate documentation, workers can raise concerns early, before problems escalate into long-term losses. When resolving disputes, pay stubs are often the first form of evidence examined by attorneys and administrative agencies. This makes their accessibility critical for workers navigating wage claims.

Technology Supporting Compliance

The shift toward digital payroll systems has made pay records more accessible than ever. Tools like a paystub creator allow small businesses to quickly generate compliant payroll documents while reducing administrative errors. Ease of documentation means employers can maintain proper records, and employees are less likely to encounter discrepancies or missing information.

Automation also reduces the chance of manual calculation errors, which are a major source of wage disputes. By using payroll technology aligned with state requirements, companies can strengthen transparency and protect themselves against litigation.

Workers Need Easy Access to Documentation

Even when employers comply with payroll rules, issues can arise if workers cannot retrieve their pay stubs when needed. Some states require that employees must always have access to current and historical pay information. A simple request for past wage records should not require navigating complex processes or waiting long periods.

Attorneys representing workers know that the success of a wage dispute case often depends on timely access to these records. Without them, employees may struggle to prove underpayment claims. Reliable access protects workers from employers who may attempt to conceal wrongdoing.

Pay Stubs and Fair Wage Advocacy

A clear pay stub not only supports compliance but also strengthens worker empowerment. When employees understand their earnings, deductions, and benefits, they can confidently speak up against errors or inequities. This contributes to a culture of trust, reduces conflict, and improves employer-employee relations.

Advocacy organizations and legal professionals often educate workers on how to read pay stubs and what red flags to look for. With the availability of digital formats like a pay stub template, employees can keep organized records and reference them during performance reviews, wage negotiations, and legal consultations.

The Future of Pay Transparency

Wage transparency laws continue to evolve. Several states now require disclosure of pay ranges in job postings, and similar policies are being considered nationwide. As transparency expectations increase, reliable payroll documentation becomes more essential. Pay stubs serve as the foundation for these efforts by reinforcing reporting accuracy and preventing income inequality.

Fair labor practices rely on accountability. Pay stubs may seem routine, but they are a powerful defense against payroll abuse and a critical tool for enforcing wage rights. When employees receive clear and precise documentation, they are better protected and more informed. As lawmakers and attorneys strive for fairer workplaces, pay transparency supported by accurate pay stubs is a key step toward long-term progress.