Fair Debt Collection Practices Act: Your Complete Guide to Federal Consumer Protection Laws and Constitutional Safeguards

Consumers frequently ask, “What protections does the Fair Debt Collection Practices Act provide against abusive debt collectors, and how do these federal regulations interact with state laws?” The Fair Debt Collection Practices Act (FDCPA), enacted in 1977, establishes comprehensive federal standards governing third-party debt collectors while preserving essential constitutional protections for both debtors and creditors. Unlike state-specific consumer protection laws, the FDCPA creates uniform national standards that prohibit abusive, deceptive, and unfair debt collection practices while maintaining legitimate creditor rights and free market principles.

The debt collection industry operates under this federal framework that balances consumer protection with constitutional due process rights and commercial speech protections. Understanding these regulations proves essential for legal practitioners representing either creditors or debtors, as violations can result in significant statutory damages, attorney fees, and regulatory enforcement actions that affect business operations and individual rights.

What Constitutional Principles Govern Federal Debt Collection Regulation?

Due process protections under the Fifth and Fourteenth Amendments require that debt collection procedures provide adequate notice and opportunity to be heard before creditors can seize property or garnish wages. The FDCPA reinforces these constitutional safeguards by mandating specific disclosure requirements and validation procedures that ensure debtors understand their rights and can challenge inaccurate claims.

Commercial speech protections under the First Amendment apply to debt collection communications, creating constitutional limitations on how broadly Congress can restrict collector speech. Courts have generally upheld FDCPA restrictions as reasonable regulations of commercial speech that serve compelling government interests in preventing consumer harassment and deception.

Interstate commerce authority provides the constitutional foundation for federal regulation of debt collection practices, as most debt collection involves multi-state operations and national creditor networks. This federal authority prevents a patchwork of conflicting state regulations while ensuring uniform protection standards across jurisdictional boundaries.

Equal protection principles require that debt collection laws apply uniformly without discriminating against protected classes or creating arbitrary distinctions between similarly situated parties. The FDCPA achieves this through broad coverage provisions that protect all consumers regardless of income, location, or debt type within the Act’s scope.

Property rights protections ensure that debt collection regulations do not constitute unconstitutional takings or impair legitimate contractual obligations between creditors and debtors. The FDCPA balances these concerns by regulating collection methods rather than substantive debt obligations or creditor remedies.

How Does the FDCPA Define Covered Debt Collectors and Consumer Debts?

Third-party debt collectors represent the primary focus of FDCPA coverage, including collection agencies, debt buyers, and attorneys who regularly collect debts on behalf of others. This definition excludes original creditors collecting their own debts, though subsequent purchasers of those debts typically become subject to FDCPA requirements.

Consumer debt coverage under the FDCPA includes personal, family, and household obligations while excluding business debts. This distinction reflects congressional intent to protect individual consumers rather than commercial entities that presumably have greater resources and sophistication to address collection issues.

Regular collection activity triggers FDCPA coverage for attorneys and other professionals who might not consider themselves traditional debt collectors. Courts have interpreted this requirement broadly, finding that even occasional debt collection activity can establish coverage when conducted systematically or as part of ongoing business practices.

Debt buyer exemptions have evolved through litigation and regulatory interpretation, with some courts finding that debt buyers who purchase portfolios of defaulted accounts qualify as debt collectors subject to full FDCPA requirements regardless of their relationship to original creditors.

Employee and affiliate relationships create complex coverage questions when creditors use related entities or contracted services for debt collection activities. The FDCPA generally covers independent contractors and separate corporate entities engaged in collection activities, even when they have close relationships with original creditors.

What Specific Practices Does the FDCPA Prohibit?

Harassment protections under Section 806 prohibit debt collectors from using profanity, making repeated telephone calls intended to annoy, or threatening violence against debtors or their families. These provisions establish clear boundaries for collection communications while preserving collectors’ rights to pursue legitimate collection efforts.

False representation prohibitions under Section 807 prevent collectors from misrepresenting debt amounts, legal status, or their identity and authority. These provisions require truthful communication about debt validation, payment options, and legal consequences while preventing deceptive practices that might mislead consumers about their obligations.

Unfair practices restrictions under Section 808 address collection methods that violate fundamental fairness principles, including postdated check deposits, excessive fees, and threats to take actions that collectors do not intend or cannot legally pursue. These provisions focus on preventing abuse rather than regulating legitimate collection techniques.

Communication timing restrictions limit when collectors can contact debtors, generally prohibiting calls before 8 AM or after 9 PM in the debtor’s time zone. These provisions recognize that consumers need reasonable privacy and rest periods while allowing collectors appropriate access for legitimate collection purposes.

Third-party disclosure prohibitions prevent collectors from discussing debt information with unauthorized parties, including family members, employers, or neighbors, except in very limited circumstances. These privacy protections balance collection effectiveness with consumer dignity and reputation protection.

How Do Debt Validation Requirements Protect Consumer Rights?

Initial disclosure requirements mandate that collectors provide specific information within five days of first contact, including debt amount, creditor name, and validation rights. This information enables consumers to verify debt accuracy and exercise their rights to challenge questionable claims before collection activities escalate.

Debt validation procedures allow consumers to request verification of debt validity within thirty days of initial contact. During validation periods, collectors must cease collection activities until they provide adequate verification, ensuring that consumers are not harassed for debts they do not legitimately owe.

Verification standards require collectors to provide meaningful proof of debt validity rather than mere statements or summaries. While the FDCPA does not specify exact verification requirements, courts have generally required documentation that reasonably establishes the debt’s existence, amount, and the collector’s authority to collect.

Dispute resolution procedures enable consumers to challenge debt accuracy and require collectors to investigate and respond to legitimate disputes. These procedures prevent collectors from continuing collection efforts on disputed debts without adequate investigation and response to consumer concerns.

Continuing obligations require collectors to maintain accurate records and refrain from collecting disputed amounts until validation is complete. These ongoing requirements ensure that initial validation procedures have meaningful effect throughout the collection process.

What Enforcement Mechanisms Does the FDCPA Provide?

Private litigation under Section 813 allows consumers to sue debt collectors for FDCPA violations in federal court, with successful plaintiffs entitled to actual damages, statutory damages up to $1,000, and reasonable attorney fees. This private enforcement mechanism provides individual remedies while encouraging compliance through potential litigation exposure.

Consumer Financial Protection Bureau oversight includes regulatory enforcement authority, examination powers, and policy guidance that shapes FDCPA interpretation and application. The CFPB can impose substantial civil money penalties and require compliance changes for systemic violations.

Federal Trade Commission coordination provides additional enforcement resources and policy development, particularly for smaller debt collectors not subject to CFPB supervision. The FTC maintains active enforcement programs that target egregious violations and emerging industry practices.

State attorney general authority allows state officials to enforce FDCPA provisions alongside state consumer protection laws, providing additional enforcement resources and local accountability for debt collection practices within their jurisdictions.

Class action litigation provides mechanisms for addressing widespread violations that affect large numbers of consumers, though recent procedural developments have created additional requirements for class certification in FDCPA cases.

How Do State Laws Complement Federal FDCPA Protections?

California regulations under the Rosenthal Fair Debt Collection Practices Act extend FDCPA protections to original creditors and provide additional consumer remedies beyond federal requirements. California’s comprehensive approach reflects state policy priorities that emphasize strong consumer protection while maintaining business certainty.

New York State debt collection regulations include licensing requirements for debt collectors and additional disclosure obligations that exceed federal minimums. These enhanced protections demonstrate how states can build upon federal frameworks while addressing local consumer protection priorities.

Texas Finance Code provisions complement FDCPA requirements through state-specific prohibited practices and licensing requirements that create additional compliance obligations for collectors operating within the state. Texas law also provides state court remedies that may offer advantages over federal litigation options.

Florida consumer protection statutes include comprehensive debt collection regulations that interact with FDCPA requirements to create layered protection systems. Florida’s approach emphasizes both regulatory oversight and private enforcement mechanisms that reinforce federal protections.

Interstate coordination through uniform state laws and reciprocal enforcement agreements helps ensure consistent protection standards while respecting federalism principles that allow states to address local concerns through tailored regulatory approaches.

What Technology and Communication Issues Affect Modern Debt Collection?

Electronic communications including emails, text messages, and automated calls raise new questions about FDCPA application to modern communication methods. Recent regulatory guidance addresses how traditional restrictions apply to digital communications while preserving consumer protection objectives.

Social media platforms create novel challenges for debt collection compliance, as collectors must navigate privacy restrictions, third-party disclosure prohibitions, and harassment prevention while utilizing modern communication tools for legitimate collection purposes.

Automated dialing systems and robocalls face enhanced regulatory scrutiny under both FDCPA and Telephone Consumer Protection Act requirements. Collectors must implement sophisticated compliance systems to avoid violations while maintaining operational efficiency.

Data security requirements for consumer information have become increasingly important as data breaches create potential FDCPA violations and expose collectors to additional liability under state and federal privacy laws.

Artificial intelligence applications in debt collection raise questions about human oversight requirements, bias prevention, and compliance monitoring that require careful attention to both technological capabilities and legal obligations.

How Do Court Procedures Affect FDCPA Litigation?

Federal court jurisdiction over FDCPA claims provides uniform procedural standards while allowing state court concurrent jurisdiction for cases that meet jurisdictional requirements. This dual jurisdiction system offers plaintiffs strategic choices while ensuring adequate forum access.

Statutory damages provisions create automatic penalties for FDCPA violations without requiring proof of actual damages, though courts retain discretion in setting award amounts based on violation severity and frequency. These provisions encourage compliance while providing meaningful remedies for consumers.

Attorney fee awards for successful FDCPA plaintiffs help ensure access to legal representation for consumers challenging violations. These fee-shifting provisions level the playing field between individual consumers and well-funded collection operations.

Class action procedures in FDCPA cases must address statutory damage limitations and individual injury requirements that can complicate class certification. Recent judicial decisions have clarified standards for class treatment while maintaining individual remedies.

Settlement considerations in FDCPA litigation often involve compliance monitoring, policy changes, and systematic reforms that extend beyond monetary payments to address underlying violation patterns.

What Compliance Challenges Do Debt Collectors Face?

Training requirements for collection personnel must address complex legal requirements while maintaining operational efficiency and customer service quality. Effective training programs combine legal compliance with practical communication skills that achieve collection objectives within legal boundaries.

Policy development requires comprehensive procedures that address all FDCPA requirements while adapting to changing legal interpretations and technological developments. These policies must be regularly updated and consistently implemented across collection operations.

Quality assurance monitoring systems help identify potential violations before they result in consumer complaints or litigation. These systems typically include call monitoring, documentation review, and compliance testing that demonstrate good-faith compliance efforts.

Technology integration must balance operational efficiency with legal compliance requirements, ensuring that automated systems incorporate appropriate safeguards and human oversight. This integration requires ongoing attention to system updates and regulatory changes.

Vendor management for third-party service providers requires due diligence and contract provisions that extend compliance obligations throughout the collection process. Collectors remain responsible for vendor compliance with FDCPA requirements regardless of contractual arrangements.

How Do Recent Legal Developments Shape FDCPA Practice?

Consumer Financial Protection Bureau rulemakings have clarified FDCPA application to modern communication methods while providing safe harbors for compliant practices. These regulatory developments offer greater certainty for collectors while maintaining consumer protection objectives.

Circuit court decisions continue refining FDCPA interpretation, particularly regarding damages calculations, standing requirements, and class action procedures. These decisions create binding precedent within circuits while contributing to ongoing legal development.

Technology guidance from regulatory agencies addresses email communications, social media contact, and automated systems while balancing innovation with consumer protection. This guidance helps collectors navigate technological advances while maintaining compliance.

State law developments continue expanding consumer protections beyond federal minimums, creating additional compliance obligations for collectors operating in multiple jurisdictions. These developments require ongoing monitoring and policy adjustment.

Industry consolidation affects FDCPA compliance as larger collection operations acquire smaller companies and implement standardized procedures across expanded operations. This consolidation can improve compliance capabilities while creating new coordination challenges.

What Professional Liability Issues Arise Under the FDCPA?

Attorney liability for FDCPA violations can include both civil damages and professional discipline, creating dual exposure for attorneys engaged in debt collection activities. Legal practitioners must understand both substantive FDCPA requirements and professional responsibility obligations.

Insurance coverage for FDCPA violations requires careful policy analysis and risk management, as some professional liability policies exclude or limit coverage for regulatory violations. Collection attorneys should review coverage adequacy and consider specialized insurance products.

Malpractice prevention in FDCPA practice requires systematic compliance procedures, regular training updates, and quality assurance monitoring. These prevention efforts help attorneys avoid both civil liability and professional discipline while serving client interests effectively.

Client counseling obligations require attorneys to advise creditor clients about FDCPA compliance requirements and potential liability exposure. This counseling helps clients make informed decisions about collection strategies while minimizing legal risks.

Continuing education requirements in many states include consumer protection law components that address FDCPA compliance and recent legal developments. These educational requirements help maintain professional competence while ensuring current knowledge of evolving legal standards.

How Do Small Claims and Alternative Dispute Resolution Interact with FDCPA Rights?

Small claims procedures in debt collection cases must comply with FDCPA requirements regarding notice, validation, and prohibited practices. Collectors cannot use small claims courts to circumvent federal consumer protection requirements or engage in abusive litigation tactics.

Arbitration clauses in consumer contracts may affect FDCPA enforcement, though courts have generally held that arbitration cannot waive statutory rights or remedies. These clauses create procedural complications while preserving substantive consumer protections.

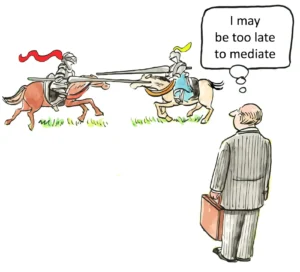

Mediation programs offer alternative resolution mechanisms for FDCPA disputes while preserving individual rights to pursue litigation when appropriate. These programs can provide faster resolution while reducing litigation costs for all parties.

Settlement conferences in FDCPA litigation often address both monetary damages and systemic compliance improvements that benefit broader consumer populations. These conferences can achieve comprehensive resolutions while avoiding extended litigation.

Administrative procedures through regulatory agencies provide alternative enforcement mechanisms that complement private litigation while addressing industry-wide compliance issues.

What International and Cross-Border Issues Affect FDCPA Application?

Multinational collection operations must navigate FDCPA requirements alongside foreign consumer protection laws when collecting debts from U.S. consumers. These cross-border operations require careful coordination and specialized legal analysis.

Offshore calling centers used by debt collectors must comply with FDCPA requirements regardless of their physical location when collecting debts from U.S. consumers. This extraterritorial application creates compliance challenges for global collection operations.

Data transfer regulations including international privacy laws interact with FDCPA requirements to create complex compliance obligations when consumer information crosses national boundaries during collection activities.

Jurisdictional issues arise when debtors relocate internationally or when collection efforts involve multiple countries. These situations require careful analysis of applicable law and enforcement mechanisms.

Treaty obligations and international agreements may affect FDCPA enforcement and collection procedures when dealing with foreign debtors or international business relationships.

How Do Bankruptcy Proceedings Affect FDCPA Compliance?

Automatic stay provisions in bankruptcy cases prohibit most collection activities and override normal FDCPA procedures, creating absolute restrictions that exceed typical consumer protection requirements. Collectors must immediately cease most collection efforts upon receiving bankruptcy notice.

Discharge violations occur when collectors attempt to collect discharged debts after bankruptcy completion, constituting both bankruptcy law violations and potential FDCPA violations. These violations can result in both bankruptcy court sanctions and civil liability.

Proof of claim procedures in bankruptcy cases require accurate debt documentation while maintaining FDCPA compliance in any direct debtor communications. These procedures allow legitimate debt recovery while preventing abusive collection practices.

Reaffirmation agreements must comply with both bankruptcy requirements and FDCPA provisions regarding debt validation and consumer rights. These agreements require careful legal analysis to ensure compliance with overlapping regulatory requirements.

Post-bankruptcy collection activities on non-discharged debts must resume FDCPA compliance while recognizing changed financial circumstances and legal status of debtors emerging from bankruptcy protection.

What Damages and Remedies Are Available for FDCPA Violations?

Actual damages compensate consumers for financial losses caused by FDCPA violations, including costs incurred due to harassment, lost wages from improper workplace contact, or expenses related to disputing inaccurate debt claims. These damages require proof of specific financial harm.

Statutory damages up to $1,000 per case provide automatic penalties for FDCPA violations without requiring proof of actual harm. Courts consider violation severity, frequency, and collector compliance efforts when setting statutory damage amounts within this range.

Punitive damages are not available under the FDCPA, as statutory damages serve the deterrent function typically addressed through punitive awards. This limitation reflects congressional balance between consumer protection and business certainty in collection operations.

Injunctive relief can prevent continuing violations and require compliance policy changes that address systemic problems beyond individual consumer cases. These remedies provide forward-looking protection while encouraging industry-wide compliance improvements.

Attorney fees for successful plaintiffs help ensure access to legal representation while creating additional deterrent effects for potential violators. Courts have broad discretion in setting reasonable fee awards based on time invested and results achieved.

What Future Trends Will Shape FDCPA Practice?

Technology integration will continue expanding collection capabilities while creating new compliance challenges that require updated regulatory guidance and industry standards. Artificial intelligence and automated systems will require human oversight and bias prevention measures.

Regulatory harmonization between federal and state agencies may provide more consistent enforcement standards while preserving state authority to address local consumer protection priorities through enhanced requirements.

Consumer education initiatives may reduce FDCPA violations through better debtor understanding of rights and obligations, creating more cooperative collection relationships while maintaining protection against abusive practices.

Industry professionalization through enhanced training, certification programs, and ethical standards may improve compliance while demonstrating collection industry commitment to legitimate business practices and consumer respect.

Legislative updates to address technological developments and evolving business practices will likely refine FDCPA requirements while maintaining core consumer protection principles and constitutional safeguards.

The Fair Debt Collection Practices Act represents a carefully balanced regulatory framework that protects consumer rights while preserving legitimate debt collection practices essential to credit markets and economic stability. Understanding these federal regulations helps legal practitioners navigate complex compliance requirements while serving both creditor and debtor clients effectively.

The conservative approach to debt collection regulation emphasizes clear legal standards, constitutional protection, and market-based solutions that encourage voluntary compliance while providing meaningful remedies for genuine violations. This framework supports both consumer protection and commercial certainty through established legal procedures.

Effective FDCPA practice requires comprehensive understanding of federal requirements, state law variations, and constitutional principles that govern debt collection activities. Through careful attention to compliance obligations and consumer rights, the legal system maintains appropriate balance between creditor remedies and debtor protection.

The evolution of debt collection practices continues reflecting technological advances, changing business models, and enhanced consumer awareness that shape modern collection industry operations. Success in this practice area requires staying current with legal developments while maintaining focus on fundamental principles that protect individual rights and preserve market functionality.

Sources:

- Fair Debt Collection Practices Act Legal Framework and Overview

- Consumer Financial Protection Bureau Debt Collection Annual Report 2023

- Federal Trade Commission Fair Debt Collection Practices Act Full Text

- American Bar Association Consumer Financial Services Answer Book 2024

- National Consumer Law Center Fair Debt Collection Treatise and Resources

- Insurance Information Institute Professional Liability Coverage Guidelines

- National Consumer Law Center State Debt Collection Policy Resources

- FindLaw Debt Collection Laws and Consumer Rights Guide

- FDIC Consumer Compliance Examination Manual FDCPA Section

- Consumer Financial Protection Bureau FDCPA Consumer Information