How to Make a Paystub That Meets All Legal Requirements

Paystubs are crucial records for both companies and employees. They provide clear evidence of income and reductions. Compliance with legal requirements ensures precision and authenticity. Paystubs serve as proof of records and are essential documents for various financial transactions. In this post, we will learn more about how to create paystubs that meet all legal requirements.

Understanding Paystub Basics

A paystub is a document that outlines an employee’s compensation, taxes paid, and other deductions. It includes the period of pay and other details of the employer. Knowing how to make a paystub helps avoid problems of misunderstanding later on.

Mandatory Details to Include

While required paystub information may differ based on the state or region, some elements are more stable. Always include the employee’s name, address, and employee ID. The name and address of the employer must also be listed.

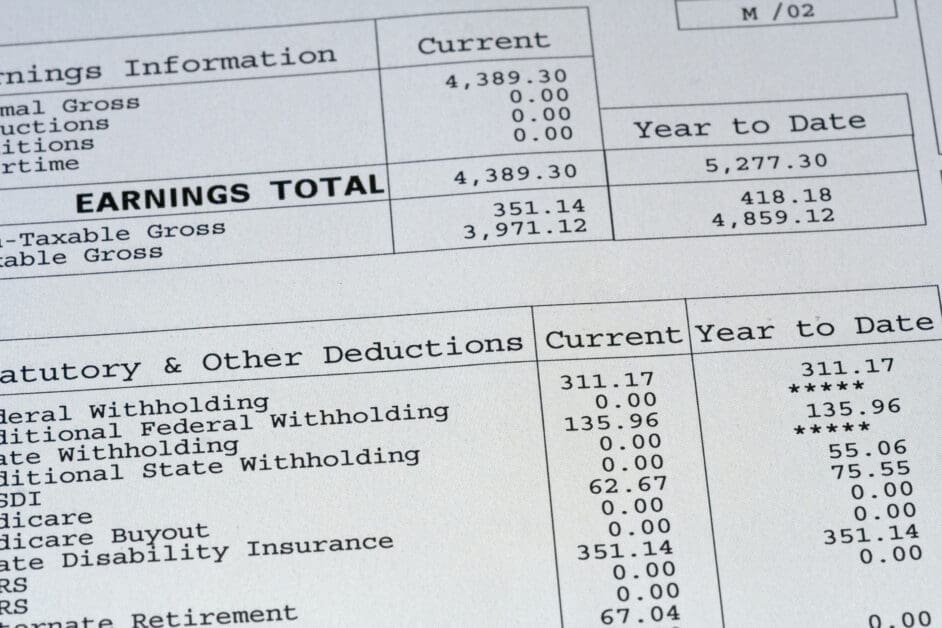

Earnings and Deductions

Record the amount of gross pay, which is the earned amount before the taxes and other deductions. Net pay (the amount you bring home) should be shown separately. Include all the deductions, which should include federal tax, state tax, health insurance, and retirement plans.

Pay Period and Dates

The pay stub should indicate the pay period it covers. Include the range of start dates and the end dates, as well as the actual date of pay. This information also allows employees to track their incomes and payments.

Tax Withholding Information

It is essential to record tax withholdings accurately. This includes breaking down federal, state, and local tax amounts. If there are additional deductions, such as wage garnishments, list those separately and clearly so they cannot be assumed to be part of the wages.

Overtime and Additional Earnings

Overtime worked by employees, as well as any bonuses, should be listed as different line items. Specify the overtime hours, the overtime rates, and the total additional earnings. Clear communication reduces disagreements and helps build trust.

Year-to-Date Totals

In many jurisdictions, paystubs must display year-to-date totals of gross pay, deductions, and net income. These totals help employees keep track of their cumulative income. In addition, it helps ensure that taxes are prepared accurately.

Accuracy and Readability

Content should be arranged clearly. Make sure it’s not messy or overly complicated. Headings should be easier to read and follow; the paystub moves logically from one section to another.

Legal Compliance

Employers need to keep a close eye on local and national legislation regarding paystub information. Review laws regularly, as these can change over time. It is always better to check reliable sources, such as government sites, so you can continue to be compliant.

Electronic vs. Paper Paystubs

Several businesses offer electronic paystubs because they are more convenient. Some laws may mandate employees’ consent before the transition to electronic records. All legal information must remain intact and readable in any format.

Recordkeeping Responsibilities

Keeping copies of pay stubs can be advantageous for both employers and employees. The law also guides how long filings must be stored. Proper recordkeeping can help avoid misunderstandings or legal disputes.

Making Corrections

Errors happen despite taking all precautions. This means that if a paystub has an error, correct it as soon as possible and send out a new version. To ensure compliance and maintain trust, corrections should be documented.

Common Pitfalls to Avoid

One common error is omitting the required details. Review each paystub and check if the information is complete before distributing it. A different frequent problem is not updating the paystub templates when regulations change.

Benefits of Accurate Paystubs

Accurate paystubs build confidence for employees and reduce conflict over salary and compensation mismatches. It helps employees, as they can easily see that pay and deductions were taken correctly. Furthermore, they also help simplify tax filing and make loan applications easier.

Seeking Professional Guidance

Employers worried about compliance can hire a payroll professional or a legal adviser for guidance. Expert insights help businesses escape the risk of fines, as well as good practices. Being aware and vigilant makes the organization a safer space for all.

Wrapping Up

Generating legally required pay stubs is essential to safeguarding both employers and employees. Maintaining accurate, regulation-compliant records requires careful attention, routine updates, and effective communication. Empowering these steps fosters trust and a seamless experience.