Taxation

Expert Legal Guidance in Taxation: Ensuring Compliance and Optimization

Taxation law is a complex and ever-evolving field, integral to both individuals and businesses. Understanding and complying with tax laws is crucial to avoid legal pitfalls and optimize financial strategies. This article explores the role of legal expertise in navigating the intricacies of taxation.

Understanding Taxation Law

Taxation law involves regulations and policies governing how governments collect taxes from individuals and businesses. These taxes can include income tax, corporate tax, sales tax, and more. The complexity of tax laws, especially in cross-border operations, requires a deep understanding and strategic planning to ensure compliance and efficiency.

The Role of Legal Experts in Taxation

Legal professionals specializing in taxation provide invaluable guidance in interpreting tax laws, planning tax strategies, and representing clients in disputes with tax authorities. They stay abreast of the latest tax regulations and use their expertise to provide tailored advice, ensuring clients adhere to legal requirements while optimizing tax liabilities.

Strategies for Effective Tax Planning

Effective tax planning involves analyzing financial situations and implementing strategies to minimize tax liabilities within the legal framework. Legal experts assist in structuring transactions, estate planning, and advising on tax-efficient investment strategies. They also help navigate the complexities of international tax laws for businesses operating globally.

Dealing with Tax Disputes and Litigation

Disputes with tax authorities can arise due to various reasons, including audits, non-compliance, or misinterpretation of tax laws. Legal professionals represent clients in these disputes, offering expert negotiation and litigation support to resolve issues effectively and efficiently.

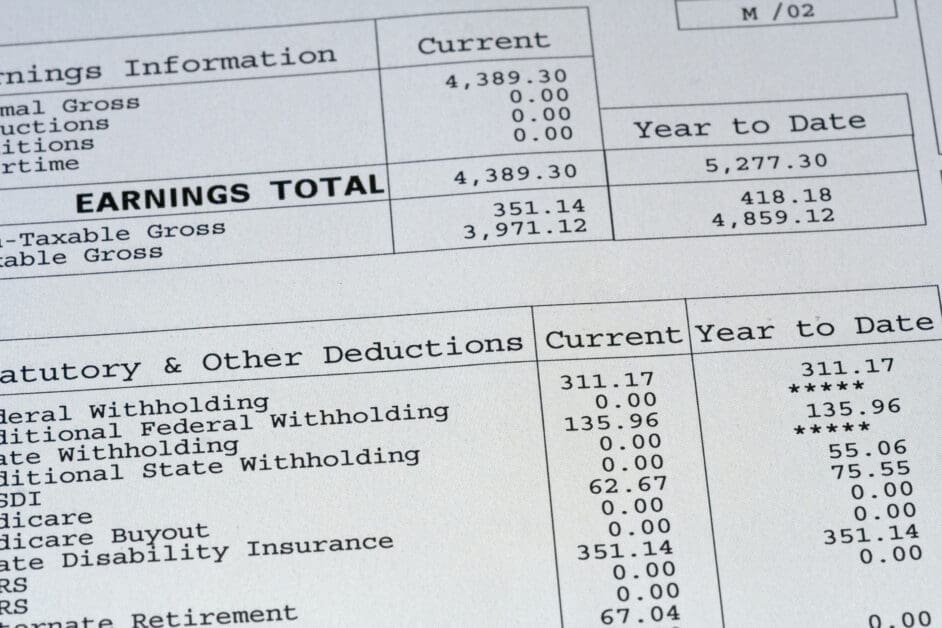

Tax Compliance and Reporting

Staying compliant with tax laws is crucial for avoiding penalties and legal issues. Legal experts assist in accurate and timely tax reporting, ensuring that all legal obligations are met. They provide guidance on documentation, deductions, credits, and reporting requirements, tailored to the specific needs of each client.

Conclusion

Navigating the complexities of taxation requires more than just financial knowledge; it requires legal expertise. Whether you are an individual taxpayer or a business entity, legal advice in taxation can provide clarity, compliance, and optimization of your financial obligations and strategies.